Financial Performance Management

In a turbulent scenario like we live now, presidents and chief financial officers are constantly under pressure: more demanding shareholders and a regulatory environment intensified by SOX. The internal environment does not alleviate these pressures because it is more complex, performance indicators grows continually and the projection capability is inadequate to handle this new scenario that arises as a Tsunami. These daily problems affect managers profoundly and impair their perception of future business alternatives. Agility, flexibility and integration become more relevant for success than old and rigid methods of command and control.

Companies need processes and tools that can do more than register and control data through transactional applications, allowing them to simulate future alternatives and predict future results in an agile, integrated and comprehensive manner.

Modeling

Financial modeling is the technique used to design a conceptual financial mockup – a set of mathematical formulas and interrelations that reproduce the company’s reactions to scale. As such, we translate the financial mechanisms that allow for agile and integrated simulations of the company operations into a software, such as sales volumes simulation and its impacts on revenue, going through inventories and costing up to projected EBTIDA and cash flow.

CTI’s financial simulation model was developed to assist executives in the simulation of strategies or changes of market or economic scenarios, increasing the safety level in decision-making.

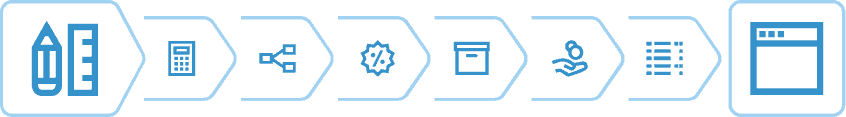

CTI’s financial integrated simulation model

Agile, integrated and comprehensive. Our financial simulation model fits perfectly, like e glove, for enterprises that operate in volatile and turbulent economies. It enables the entry of countless indicators and its rapid data processing produces reliable databases for decision-making. It has never been so easy to evaluate the impacts of your strategies.

If you wish to know the economic and financial impact of a given decision, contact us. CTI has translated the financial mechanisms that allow for estimates such as sales volume simulation and its impacts on revenue, inventories, costing and projected EBTIDA and cash flow into a software.

The customized model for each customer recalculates scenarios in a few minutes, allowing you to make general or partial simulations during decision-making meetings. Therefore, you can project scenarios with monthly simulations over a 3-year period, or annual simulations for up to 20 years, and executives can evaluate the best strategic decision for each possible scenario.

Beyond agility, those simulations are technically consistent and reliable, as they follow the best practices and the business rationale of successful enterprises from different industries, as well as the accounting-finance logic.

Simulations evaluate impacts on production, costs, working capital, earnings and expenditures, taxes, etc., and also prevent errors and inconsistencies commonly found in manual, time-consuming Excel spreadsheet budgeting.

Applications

What if scenarios and budget generation.

Monthly Rolling Forecasts.

Market-strategy simulation.

Economic and financial impact evaluation of business decisions.

Business valuation and return on investment analysis.

Examples of possible simulations

- Impacts of sales volumes variations and price policies/discounts per product (Families, categories, sub-categories, etc.) on several distribution channels and geographical regions;

- Price increase effects on raw materials, energy and other production inputs;

- Modifications in inventory levels of raw materials and finished products, and consequent effects on production plans;

- Changes in technical production rates (bill of material, energy, labor time, etc.);

- Simulation of fixed expense variations – OPEX; Operational, Administrative and Commercial;

- Headcount turnover, salaries and other costs related to personnel;

- Effects of increased or decreased investments – CAPEX;

- Different economic scenario alternatives (Market, inflation rate, exchange rates, etc.).

Customers with CTI solution deployed:

Success case:

Product used in solution:

IBM Planning Analytics TM1

The technological foundation of the model is Planning Analytics – TM1, a multidimensional OLAP tool with state-of-the-art “in memory” technology, web access, completely integrated, highly scalable and fast, which provides a unified and secure planning environment. The application can be installed on enterprise servers – On Premise or On Cloud IBM.

Integration and comprehensiveness

Every new simulation triggers pertinent recalculations, providing a broad financial view of each simulated scenario (sales, income, tax, production, raw material consumption, raw materials used and other variable costs, stock turnover, fixed costs, investments, loans and funding, etc.) and generating integrated Income Statements, Balance Sheets and Cash Flows.

Reliability

The projected financial statements are reliable because they follow business logics and accounting-financial rules that are pre-programmed by CTI professionals – business experts with extensive experience in various industry segments.

Speed

The model recalculates scenarios in a few minutes, allowing you to perform general or partial simulations during decision-making meetings. Thus, with projected scenarios, rolling forecasts and monthly simulations of up to three years, or annual simulations of up to twenty years in their hands, company executives evaluate the best strategic decision for each situation or scenario, rapidly and accurately.

The Integrated Financial Simulation Model is agile, integrated and complete, perfect for companies that must act in unstable and turbulent economic scenarios: